What is CapEx and OpEx

Tuesday, August 16, 2022

If you want to run a successful business, there are financial terms you should familiarize yourself with them. For instance, you should understand the difference between CapEx and OpEx before you dive into strategic investments and CapEx project management.

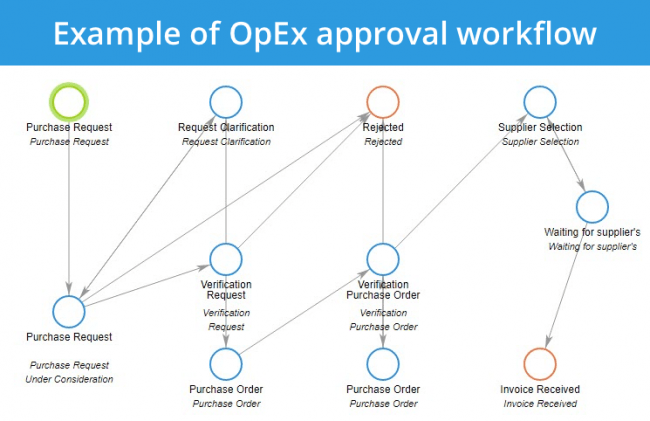

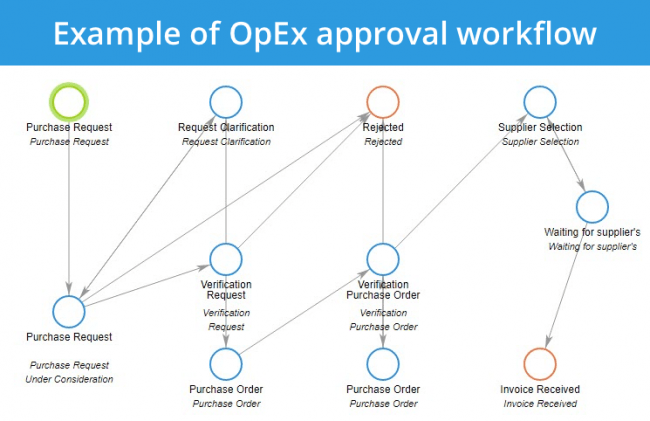

Operational expenditure consists of those expenses that a business incurs to run smoothly every single day. They are the costs that a business incurs while in the process of turning its inventory into an end product. Hence, depreciation of fixed assets that are used in the production process is considered OpEx expenditure. OpEx is also known as an operating expenditure, revenue expenditure or an operating expense.

Understanding CapEx vs OpEx difference is crucial for any business struggling to optimally utilise finance by making sure that the correct mode is used for capital expenses and other types of expenses. Below you will find a complete guide to Capex vs Opex, explaining the benefits and disadvantages of both, and how to manage them effectively.

CapEx – Capital expenditures are not fully deducted in the accounting period they were incurred. In other words, they are not fully subtracted from the revenue when computing the profits or losses a business has made. However, intangible assets are amortized over their lifespan while the tangible ones are depreciated over their life cycle. All monies spent to get new inventory, including machinery or intellectual property, are grouped under CapEx spendings.

OpEx – Operating expenses are fully deducted in the accounting period they were incurred. All funds spent when converting inventory into throughput falls under OpEx. This includes employee wages, repair and maintenance of equipment, rental fees, and utility bills and so on. If a business invests in real estate, this spending is approved as CapEx budget and the expense is grouped under CapEx. However, all the costs incurred when managing such an income generating building falls under OpEx.

Get Case Study!

A business that wants to boost its profits and book value can opt to incur a capital expense by purchasing a new machine rather than leasing one. It will have to deduct a small portion of it as an expense in that accounting year. In such a case, the business’ balance sheet would indicate a higher value of assets and net income. It also means that it would save very little on tax.

Capital expenditures entail huge investments in goods that are placed on the balance sheet and are then depreciated over the life of the asset. On the other hand, operating expenditures appear on the profit and loss A/C. They relate to costs incurred on a continuous basis. If you are in an organization that anticipates quick growth or technological changes, OpEx should suit you best. Instead of purchasing a capital good and then getting stuck with it, you will be better of leasing one. Once you pay your leasing fee, there will be no further financial obligation on your part. But if you cannot avoid CapEx, and have no limited access to capital investments (sounds like a CapEx controller dream), you should go for it and make sure that you have a CapEx project management professional on a full-time basis. Now you have the answer to this, what is CapEx and OpEx, and it is upon you to decide which one to go with.

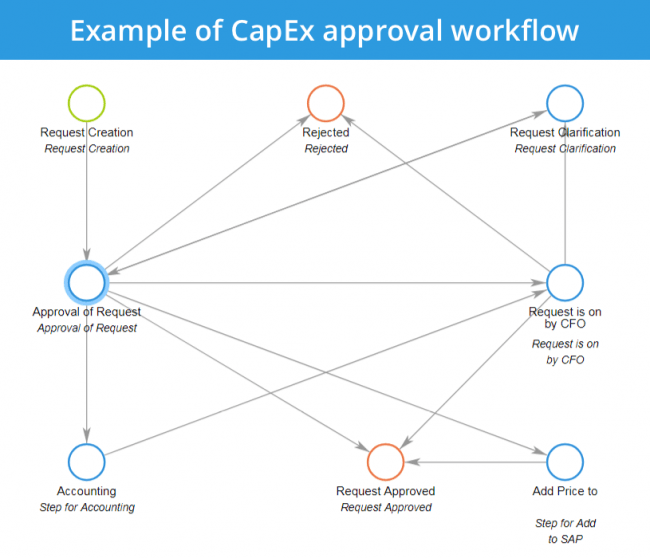

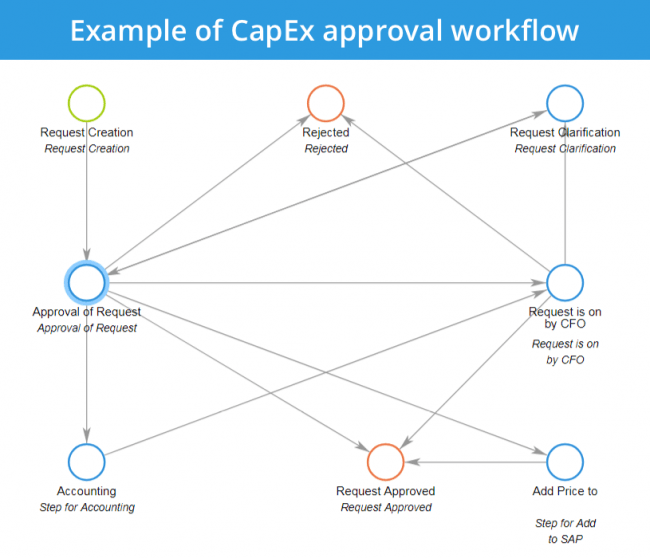

When diving deeper into CapEx management during a crisis, it might be useful to consider using a ready-to-use CapEx approval workflow template for quick start and making sure that your investments are safeguarded when CapEx approval cycles are short.

This template is delivered at as part of CMW COVID-19 Recovery Kit designed to automate daily routine quickly, collaborate effectively, track work progress and bring out the best in remote work. The Kit includes the following ready-to use workflow templates:

Table of Contents

What is CapEx and OpEx?

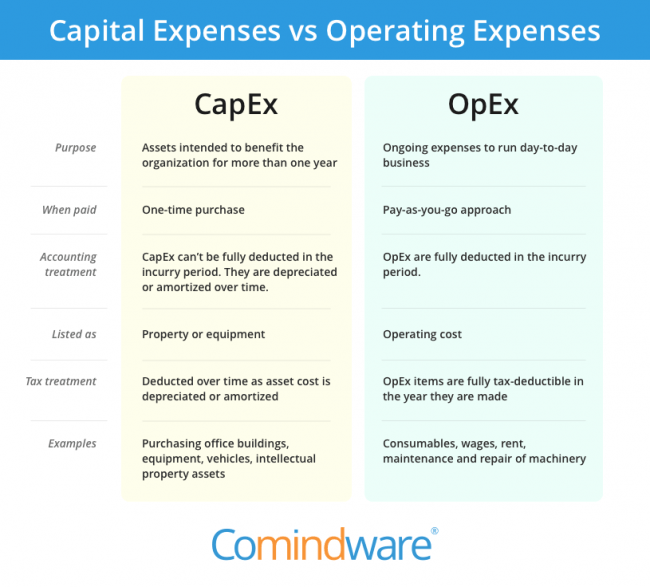

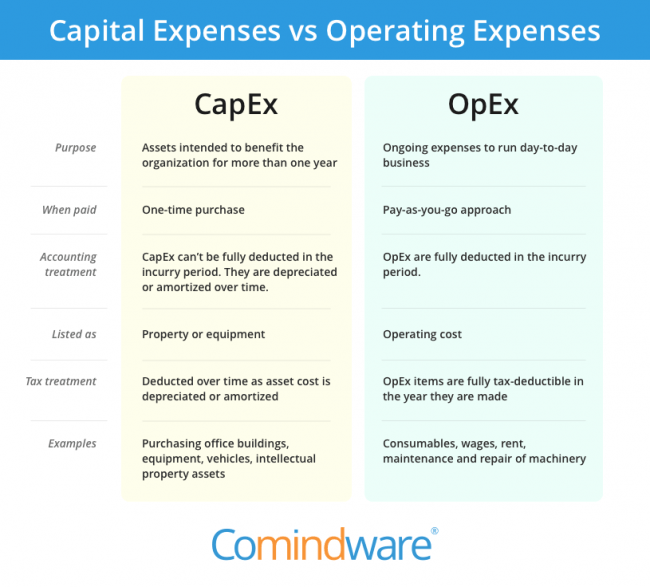

CapEx refers to a Capital expenditure while OpEx refers to an Operational expenditure. Capital expenditure is incurred when a business acquires assets that could be beneficial beyond the current tax year. For instance, it might buy brand new equipment or buildings. Also, it could upgrade an existing asset to boost its value beyond the current tax year. CapEx is also known as a Capital expense.Operational expenditure consists of those expenses that a business incurs to run smoothly every single day. They are the costs that a business incurs while in the process of turning its inventory into an end product. Hence, depreciation of fixed assets that are used in the production process is considered OpEx expenditure. OpEx is also known as an operating expenditure, revenue expenditure or an operating expense.

Understanding CapEx vs OpEx difference is crucial for any business struggling to optimally utilise finance by making sure that the correct mode is used for capital expenses and other types of expenses. Below you will find a complete guide to Capex vs Opex, explaining the benefits and disadvantages of both, and how to manage them effectively.

How CapEx and OpEx are Treated in Accounting

CapEx – Capital expenditures are not fully deducted in the accounting period they were incurred. In other words, they are not fully subtracted from the revenue when computing the profits or losses a business has made. However, intangible assets are amortized over their lifespan while the tangible ones are depreciated over their life cycle. All monies spent to get new inventory, including machinery or intellectual property, are grouped under CapEx spendings.

OpEx – Operating expenses are fully deducted in the accounting period they were incurred. All funds spent when converting inventory into throughput falls under OpEx. This includes employee wages, repair and maintenance of equipment, rental fees, and utility bills and so on. If a business invests in real estate, this spending is approved as CapEx budget and the expense is grouped under CapEx. However, all the costs incurred when managing such an income generating building falls under OpEx.

CapEx Summary

- Purchase of fixed assets.

- Preparation of the purchased asset so it can be appropriate for business use.

- Fixing of asset’s problems,

- Restoration of an asset’s value through upgrading

- Adapting a machine to a different use

Operating Expenditures Summary

- License fees

- Advertising costs

- Legal and attorney fees

- Telephone and power overheads

- Insurance fees

- Property management costs

- Property taxation expenses

- Vehicle fuel and repair costs

- Leasing commissions

- Salary and wages

- Raw materials and supplies

- Office overheads

IT Spending – CapEx or OpEx?

Traditionally technology investments most often were considered for capital expenditures over OpEx, because CFOs could take advantage of amortization these expenses over an extended period of time. Nowadays, more and more companies switch IT investment from CapEx to OpEx and they have a reasonable argument for this switch – moving company IT infrastructure to the cloud. Once this moving happens, additional CapEx benefits fall as far as the company no longer needs static investments for the hardware, software and resources. Services and options are purchased as needed, costs are fluctuating and OpEx works better for such expenses type and supports necessary scalability.What Do Most Businesses Choose Between the Two?

Now you can answer this: What is CapEx and OpEx. But which one of the two would you prefer? From the income tax perspective, most entrepreneurs prefer OpEx to CapEx. A case in point is when a business opts to lease rather than buy equipment to be able to deduct its full cash expense for leasing when computing its taxes for that accounting year. The benefit of having the ability to deduct expenses is the fact that it minimizes the income tax that is charged on your net income. Besides, you will only incur an operational cost once you lease the item again.Get our PDF Case Study to learn how Hertz has leveraged CMW Tracker to create a modern CapEx approval application, which replaced complex Excel files and dramatically reduced the capital expenditure approval cycle time, decreased operational expenses and minimized financial risks.

When a Business Can Opt for CapEx

A business that wants to boost its profits and book value can opt to incur a capital expense by purchasing a new machine rather than leasing one. It will have to deduct a small portion of it as an expense in that accounting year. In such a case, the business’ balance sheet would indicate a higher value of assets and net income. It also means that it would save very little on tax.

Capital expenditures entail huge investments in goods that are placed on the balance sheet and are then depreciated over the life of the asset. On the other hand, operating expenditures appear on the profit and loss A/C. They relate to costs incurred on a continuous basis. If you are in an organization that anticipates quick growth or technological changes, OpEx should suit you best. Instead of purchasing a capital good and then getting stuck with it, you will be better of leasing one. Once you pay your leasing fee, there will be no further financial obligation on your part. But if you cannot avoid CapEx, and have no limited access to capital investments (sounds like a CapEx controller dream), you should go for it and make sure that you have a CapEx project management professional on a full-time basis. Now you have the answer to this, what is CapEx and OpEx, and it is upon you to decide which one to go with.

CapEx Management in the Wake of COVID-19

It is evident that the pandemic-fueled crisis has significantly impeded many businesses’ ability to invest and execute capital projects. So, Chief Financial Officers and company leaders need to quickly reset their CapEx portfolios in order to make sure that every investment is worth the effort and money and helps business with staying afloat. To do so, it becomes even more important to optimize CapEx portfolio on a constant basis and make sure that each CapEx request goes through a rigorous evaluation and approval process quickly. This approach sets up a blueprint for long-term and effective CapEx portfolio optimization and ensures that executives catch advantage of new growth opportunities, while safeguarding business from the financial drain.When diving deeper into CapEx management during a crisis, it might be useful to consider using a ready-to-use CapEx approval workflow template for quick start and making sure that your investments are safeguarded when CapEx approval cycles are short.

This template is delivered at as part of CMW COVID-19 Recovery Kit designed to automate daily routine quickly, collaborate effectively, track work progress and bring out the best in remote work. The Kit includes the following ready-to use workflow templates:

Posted on: in CapEx